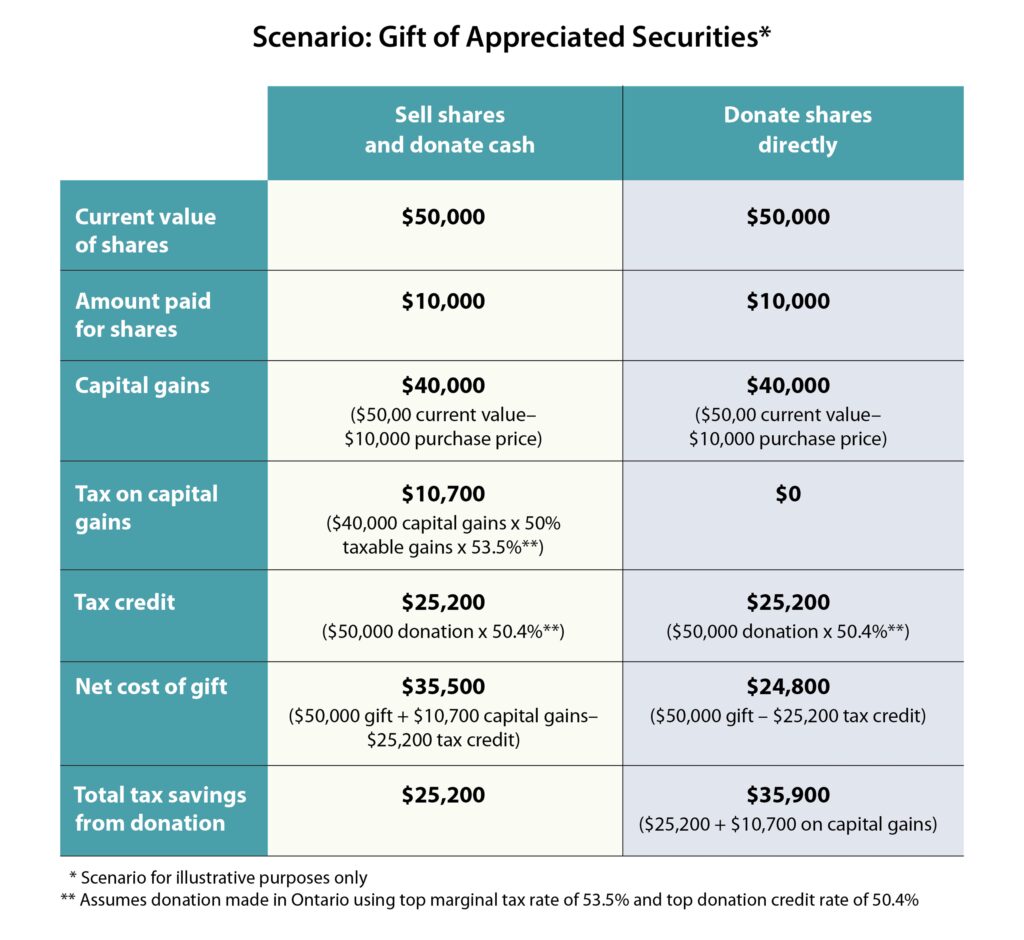

Gifts of stocks, bonds, or mutual funds that have appreciated in value are a tax-smart way to make a legacy gift. When you sell a stock, bond, or mutual fund privately, 50% of all capital gains are subject to tax. But if you donate those same securities directly to a registered charity, all taxes on capital gains are eliminated, plus you receive a donation tax receipt for the full market value of the securities.